Disclaimer: This article is produced by ClimateWorks Australia. ACE or ACCEPT is not responsible for the content.

To date, almost all Southeast Asian nations have announced net zero emissions pledges, accounting for about 91 percent of the region’s carbon emissions. Maintaining the pace of this growing ambition and seizing emerging decarbonisation opportunities are essential as the path towards achieving the net zero in the region is narrow and brief.

This year’s United Nations Framework Convention on Climate Change (UNFCCC) Conference of the Parties (COP) was arguably important in signalling Southeast Asia’s growing climate ambition. By the end of COP26, eight out of ten ASEAN Member States (AMS) had pledged to net zero emissions, with Vietnam and Thailand announcing their aspirations at the conference following announcements by Lao PDR, Indonesia and Malaysia on the road to COP26. Meanwhile, Brunei Darussalam, Myanmar, and Singapore were among the first movers to announce net zero targets as early as last year.

These targets already cover around 91 percent of the region’s total carbon emissions. According to International Energy Agency (IEA) emissions database, in 2019, ASEAN CO2 emissions accounted for 1,610 MtCO2 which are in large part incurred from coal and oil utilisation. If we exclude Cambodia and the Philippines, emissions would sum to 1,462 MtCO2. The three biggest emitters in the region are Indonesia, Vietnam, and Thailand with shares of 36%, 18%, and 16%, respectively. Unlike Indonesia and Vietnam – in which coal is the biggest carbon contributor, Thailand’s emissions are rooted mostly in natural gas.

To this end, when taken together, the emerging vision crystalising for AMS to reach net zero economies between 2050 and 2065 could potentially see the region surpassing the existing region-wide renewables targets articulated under APAEC. Here are three propositions, based on analysis from Phase 1 of the ASEAN Green Future Project.

Proposition 1: Taking a dual approach to transition, whereby coal phase-out is coordinated in tandem with the region’s renewables push, can also yield benefits for future energy security.

ASEAN is home to 12 per cent of the global coal-fired power plant (CFPP) operating capacity, with plans to add more than 95 GW new capacity to meet the region’s surging energy demand. Coal is estimated to overtake natural gas as the main power source in ASEAN by 2030, and under the APAEC Targets (APS) Scenario detailed in the 6th ASEAN Energy Outlook, which assumes APAEC targets are met, the quantity of coal in ASEAN’s primary energy supply will continue to grow to 2040. Increasing dependence on coal contrasts with the energy security goals of many ASEAN countries, with only Indonesia having sufficient coal reserves to avoid imports in the long term. In the other ASEAN countries, rising coal consumption may also burden trade balances.

In this case, coal retirement, coupled with the continued expansion of renewables, is an important step to aligning with net zero targets. The good news is that half of AMS are signatories to the international effort to end coal utilisation in the power sector. Brunei Darussalam, Indonesia, the Philippines, Singapore, and Vietnam signed on to the Global Coal to Clean Power Transition agreement during COP26. These commitments cover three-quarters of ASEAN’s coal emissions already. Moreover, Indonesia, the Philippines, and Vietnam are participating in an early coal retirement initiative under the leadership of the Asian Development Bank, targeting a total reduction of 24.5 GW in CFPP capacity.

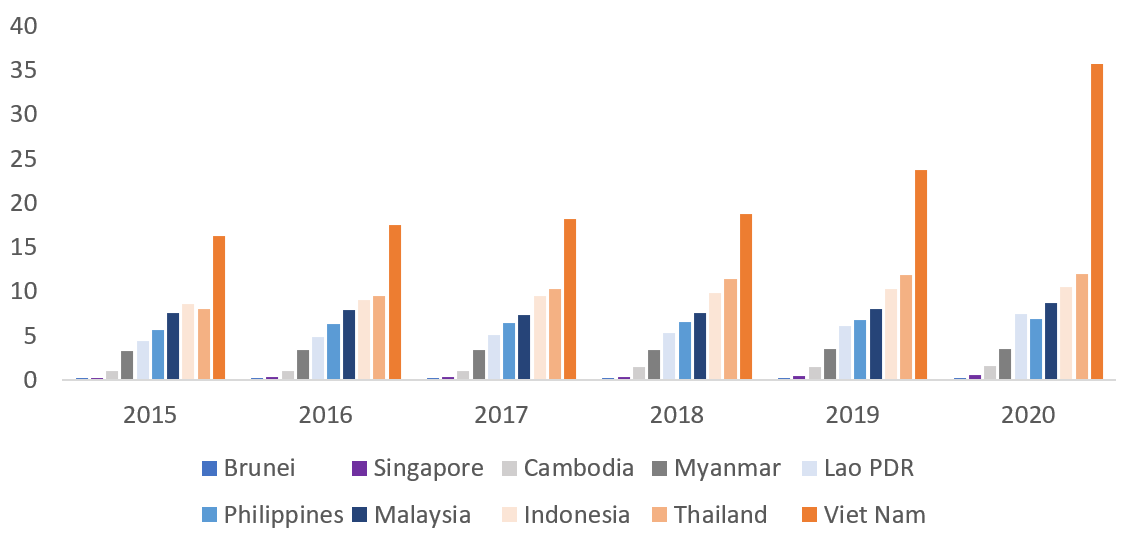

There has also been an accelerating deployment of renewable energy (RE) in the region. Between 2015-2020, the total installed capacity from renewables jumped from 54.8 GW to 86.7 GW according to International Renewable Energy Agency (IRENA) statistics. By the end of 2020, Vietnam, Thailand, and Indonesia were leading the regional race with a total of 35.6 GW, 12.0 GW, and 10.6 GW of installed RE capacity, respectively.

Aggregate Installed Capacity (GW) by AMS: 2015 – 2020

Source: IRENAStats Database (2021)

Unlike other regions and countries, this immense progress is mainly driven by the supportive policy and regulatory settings and innovative procurement models for renewables. Vietnam and Thailand are exemplary ASEAN representatives who successfully designed an attractive and stable feed-in tariff scheme with the reverse auctions and bulk procurement models. As a result, Vietnam made a gigantic 16.4 GW of additional solar PV capacity in only two years (2019 to 2020). Following Thailand and Vietnam’s success, other AMS can replicate their approach by tapping the region’s vast RE resources – estimated to comprise a theoretical capacity of 8,000 GW of solar, 229 GW of wind, 200 GW of geothermal, 158 GW of hydropower and 61 GW of biomass – and raise capacity additions beyond the existing electricity development plans.

Given the Covid-19 situation, the challenge to push RE installation is often faced with the increasing reserve margin capacity. Electrification of transport (and industry) could step in to drive up the electricity demand. The shift to electromobility is pivotal for Southeast Asians for two main reasons: reducing urban air pollution while at the same time decreasing dependence on oil. Combined and coordinated measures from the coal phase-out and renewables push will power the electric vehicle’s ecosystem to the next level.

Proposition 2: Deepening regional cooperation on power sector decarbonisation efforts will be critical for a fast, efficient, clean energy transition and solid economic recovery from the global pandemic.

ASEAN as a region has committed to integrating 23% of renewable energy by 2025, with regional grid interconnection and cross-border power trade a necessary means for achieving this target. This pledge is realised through the ASEAN Power Grid – an initiative to connect the region, initially on cross-border bilateral terms, then gradually expanding to the sub-regional level and finally to an integrated Southeast Asia power grid system.

Global evidence suggests that an integrated regional grid will allow ASEAN member states to transition to clean energy faster, more cheaply and achieve higher reliability from intermittent renewable energy sources. While positive momentum to develop the institutions to oversee regional power trading is underway, further effort is required to develop human resourcing capacity, create clean energy-oriented power markets, build technology supply chains and unlock infrastructure investment to enable the scale and pace of transformation needed.

However, a shift towards an integrated regional grid must be coupled with ambitious national renewable energy targets and an enhanced enabling policy environment in AMS. Ambitious renewable energy targets supported by more robust regional power trading can also help avoid locking in fossil fuel-based infrastructure, which risk asset stranding in a Paris-aligned global transition, and risk increasing the energy generation cost if carbon pricing and other environmental externalities are factored in. Targeting renewable electrification strategies in building, transport, and industry sectors is also essential in generating demand for renewable energy products.

Fortunately, these efforts are highly consistent with a ‘green’ economic recovery from the Covid-19 pandemic. A substantial body of evidence shows that prioritising ‘green’ creates more jobs and better economic multiplier benefits than business-as-usual stimulus measures.

Proposition 3: The international community and key partners will be instrumental in supporting ASEAN to accelerate its mission to a low-carbon energy transition through the enhanced provision of climate financing and facilitation of low-carbon technological transfer.

Developed countries’ financial support is also key to bolstering the delivery of the first proposition: reducing the share of fossil fuels consumed in the region while also bolstering the deployment of renewables. Although climate financing was trending upward prior to COVID-19, the sum has consistently fallen short of the $100 billion per year commitment made at COP15.

Particularly important for member states with less fiscal capacity and local market maturity is the enhanced provision of affordable, concessional loans from bilateral and multilateral partners as recent analysis suggests that developing economies can face higher costs of capital for renewable energy projects. While strengthened domestic enabling environments, and local capital market maturity can remedy this in the longer term, affordable financing that helps overcome these barriers is an important catalyst.

Key actions include, but are not limited to:

Industrialised nations can also facilitate the transfer of low carbon technology (LCT) for AMS. A recent study finds that high-income nations account for over 70 per cent of total LCT exports and 62 per cent of LCT imports. Meanwhile, low-income countries account for only 0.01 and 0.3 per cent, respectively, and lower-middle-income countries comprise 1.9 per cent and 6.2 per cent, respectively. Positively, this study finds that Malaysia, Thailand and Vietnam are among the top ten middle-income LCT importers and exporters, but there is still a need for measures that provide other middle and lower-income AMS with the technologies required for transition.

LCT transfer at scale will also trigger co-benefits beyond the energy-based sectors. For instance, based on the country-level analysis from Cambodia, renewable energy technologies could maximise the country’s hydropower potential and further develop low emissions agricultural technologies. In addition, land and coastal-based resilience technologies are essential to address the region’s vulnerability to climate change impacts.

The momentum is firmly with ASEAN, and there is little doubt that the region, with the right supports, will build on this ambition to go further, faster, together in its energy transition and the global race to a green future.

—————————–

Phase 1 of the ASEAN Green Future project is a collaboration between the Sustainable Development Solutions Network, ClimateWorks Australia, the Jeffrey Sachs Center on Sustainable Development at Sunway University, and research groups from across Southeast Asia (Cambodia, Indonesia, Lao PDR, Malaysia, and Thailand, with potential participation by Brunei, Myanmar, Philippines, Singapore, and Viet Nam in the future). The project aims to demonstrate how sustainable, decarbonized economies offer enhanced economic development and more resilient futures for the region.

The Phase 1 report of each country team presents priorities and actions to date, and key technology and policy opportunities to further advance domestic climate action. The Phase 1 regional report situates the region’s path to low-carbon transition within a global context using the country reports and other studies. The reports can be found here.

—————————–

Jannata Giwangkara is an energy and climate practitioner and currently serves as a Senior Project Manager at ClimateWorks Australia. Egi, his nickname, is passionate about decarbonisation and net zero transition. He has previously worked as an energy transformation manager at one of Indonesia’s most prominent energy think tanks: the Institute for Essential Services Reform (IESR). Egi also has portfolios with multinational development agencies like UNDP, USAID, and GIZ in climate and energy-related works. The University of Auckland and IPB University are his two alma maters.

Michael Dolan is a Project Manager in the International and Country Context team at ClimateWorks Australia who focuses on the political economy of climate change, the climate-development nexus, regional and global affairs, and strategic partnerships for climate action. He has previously completed a Master of Environment (with Distinction) and an Honours in Political Economy at The University of Melbourne.